JettFrogg is often confronted with people who are skeptical of our miles lifestyle, but enjoy hearing our stories of first class international travel. While we spend our days scouring the internet for the best Credit Card sign up bonuses, miles purchase deals and other ways to increase our points haul we know that a lot of our friends are a bit skittish when it comes to these practices. There are, however, some simple ways to increase your pool of miles without doing much other than changing the way you pay bills and spend money on daily goods

Bills

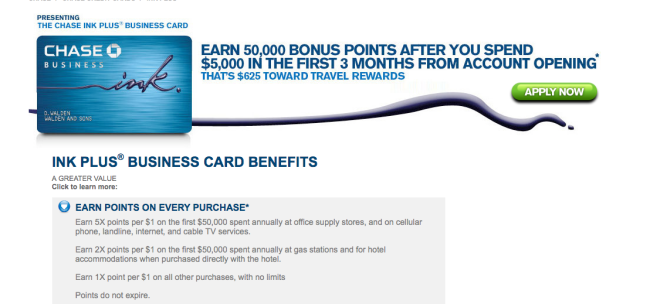

Almost all household bills can be paid with a Credit Card for no extra fee, however, most people I know pay with a check or direct bank withdrawal. Take for example Cable/Internet/Phone expenses: For a long time JettFrogg has been lauding the miles earning opportunity of Chase’s Business Cards, which can be opened by anyone. These offer a 5 :1 yield on all telephone, mobile phone, cable, internet, office supply and TV services. In my own circumstances this is what the yearly yield in Ultimate Rewards points looks like:

Cell Phone – $1,400 per year

Cable/TV/Internet – $3,600 per year

Office Supplies – $2,000 per year

Total $7,000 x 5 = 35,000 Ultimate Rewards points (transfer 1:1 to hyatt, united, british airways)

35,000 UR points for a simple change to how I pay a set of monthly bills is well worth it. This is 35% of a business class ticket to Europe on Star Alliance or a $1,000 value at Hyatt, depending on what hotels I choose to stay at. For those with family or business cell phone plans, this haul could be 2 to 3x’s bigger.

Shopping

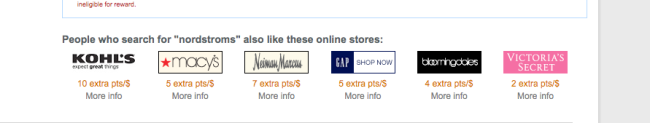

JettFrogg #1 has a rule for the women in his life (namely his wife and sister) that when you shop it has to be purchased online through a points portal. You might be asking what is a points portal? Simple – all airline programs (United/American/US Airways) and most credit card programs (Chase Ultimate Rewards) offer the ability to earn more miles by using their portal to shop. These loyalty programs have sold miles to countless major retailers as an enticement for you to shop at their stores. Continuing to use Ultimate Rewards as our example, on average if a family of 4 was spending $833 a month on household expenses (diapers, clothes, electronics, etc.) and changed their spending habits to buy through the online mall their points total would look something like this:

Total Yearly Expenses for a Family of 4: $10,000

Ultimate Rewards Mall Points: 40,000 to 60,000 Ultimate Rewards Points (most retailers offer between 4-6x points per dollar spent). A significant amount of points for simply changing how you buy monthly necessities.

JettFrogg further takes advantage by timing buys to frequent specials that most retailers offer throughout the year. For example, Home Depot normally offers 3x points per dollar spent. During the course of the year they offer 10 or 15x points per dollar as promotions. When I recently purchased a new washing machine, I made sure to time my purchase with one of these bonuses. My $600 washing machine netted 9,000 in Ultimate Rewards points. Seeing as how this was a purchase I had to make (my old machine broke), capitalizing on miles was the best way to take the sting out of this type of mandatory spend.

In conclusion, you don’t need to churn credit cards, have super secret elite airline status or even travel that much to build a base of valuable points. It just takes some knowledge and small switches in your monthly bill payment planning.

Happy #hoppday

JettFrogg #2

Categories: Miles/Points